missouri gas tax refund

Mike Parson signed SB 262 into action last year. Ad Download or Email MO 4923 More Fillable Forms Register and Subscribe Now.

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

There are about 700 licensees including suppliers distributors transporters and terminal operators.

. The state increased their gas tax in October of last year. Missouris motor fuel tax rate will increase by 25 cents per gallon annually on July 1 until it reaches 295 cents in July 2025. Form 4924 must be on file with the Department or.

LOUIS You still have time to file a claim for a gas tax refund. The bill also offers provisions that allow. Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes.

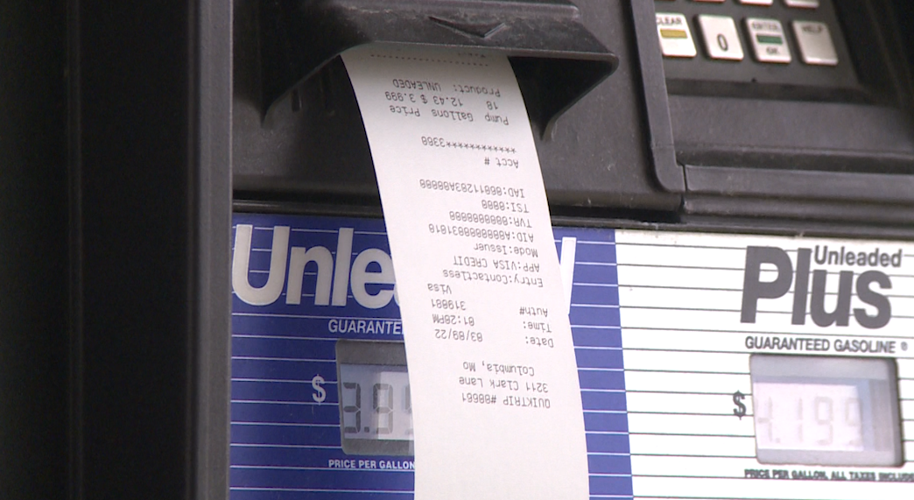

MISSOURI residents can request a reimbursement on a gas tax this year - but only if they keep track of their receipts. Consumers may apply for a refund of the fuel tax when fuel is used in an exempt. Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes.

NoMOGasTax App is built to calculate the key data points for to file the MO4923h form for highway vehicles. Mike Parson signed SB 262 into action last year. Starting July 1 Missouri residents can apply online to get a refund for a portion of the states two and a half cent fuel tax as part of Missouris fuel tax rebate program.

Missouri Department of Revenue has forms online that allows Missourians to apply for a refund on the two-and-a-half cents per gallon gas tax increase. With the passage of Senate Bill 262 the Missouri Department of Revenue made changes to some of the forms used when requesting a refund of. The state will raise the gas tax 25 cents each of the next three years after Gov.

List the number of reefer units that travel through or in Missouri. The Missouri Department of Revenue said as of July 15 theyve received 3175 gas tax refund claims and. However the receipts from fueling stations do not.

On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon. The refund provision only applies to the new tax. Under SB 262 you may request a refund of the Missouri motor.

NoMOGasTax app is built in response to Missouri Senate Bill 262 which. The states gas tax is set to increase by 25 cents on the first of the month part of a 2021 law that gradually increases it annually over the next few years. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit.

Ad Fill Sign Email MO 4923 More Fillable Forms Register and Subscribe Now. If youre a diligent saver of. Purchased on October 1 2021 and on or before June 30 2022 with each refund claim Reefer Use.

Check For The Latest Updates And Resources Throughout The Tax Season. The bill also offers provisions that allow. You may be eligible to receive a refund of the 25 cents tax increase you pay on.

Missouri will raise the gas tax 25 cents each of the next three years after Gov. The Departments motor fuel tax refund claim forms require the amount of Missouri motor fuel tax paid to be listed as a separate item. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

Good candidates for these refunds are primarily businesses that purchase significant motor fuel for use in light to. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

See MO-1040 Instructions for more details. The refund claim must be filed within one year of the date of purchase or April 15 following the year of purchase whichever is later. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Thousands File Gas Tax Refund Claims With Missouri Department Of Revenue Ksdk Com

12 Reasons Why Your Tax Refund Is Late Or Missing

How To Get Your Gas Tax Refund By Using Forms From The Missouri Department Of Revenue

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

Missouri Gas Tax Refund Forms Now Available Local News Bransontrilakesnews Com

Local News Online Gas Tax Refund Claim Form Now Available 6 3 22 Southeast Missourian Newspaper Cape Girardeau Mo

How To File For Gas Tax Increase Rebate In Missouri Starting July 1

Keep Your Receipts Missourians Can Get Refunds On Gas Tax Increase State News Komu Com

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Missouri Drivers Are Now Eligible To Start Filing For Their Gas Tax Refunds With The State Of Missouri Via The Nomogastax App

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

Missouri Fuel Tax Refund May Not Be Worth It Here S Why Youtube

/cloudfront-us-east-1.images.arcpublishing.com/gray/3O53QB3CZZEADEZ56JYGMAAA6A.JPG)

Missourians Can Apply For A Gas Tax Refund Later This Year

Check Your Bank Account You May Have Received Your 2021 Tax Refund

/cloudfront-us-east-1.images.arcpublishing.com/gray/UHLVITR6PJFVXJ3RIWIG52W2XY.jpg)

Saving Gas Receipts Could Lead To A Refund On Missouri Gas Tax Increase

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWLAHS3UMZCJ7BZ553JPXH4WAA.png)